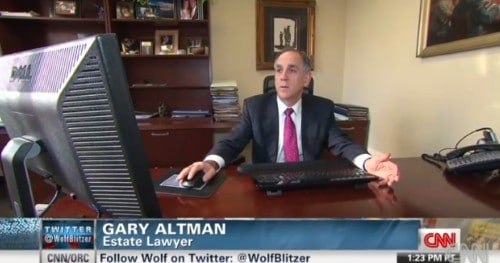

CNN called upon the expertise of estate and tax planning attorney, Gary Altman, Esq., yesterday for a segment dedicated to the impending fiscal cliff. The discussion centered around the various tax and legal strategies being used right now to curb the significant financial implications that are likely to occur if the lame duck Congress is unable to negotiate changes before the end of the year. Changes in 2013 include a significantly lower estate and gift and generation-skipping transfer tax exclusions, higher transfer tax rates and higher capital gains taxes.

Altman, who describes the final days of 2012 as "a feeding frenzy of a tax break that is going to be going away," is busy assisting clients with gifting assets to children and grandchildren before the end of the year.

In September of this year, Altman was interviewed by CNN for a piece on Mitt Romney's use of Intentionally Defective Granter Trusts.