With the ongoing rise in the costs associated with a college education (i.e. tuition, room, board, books, etc.), the emphasis on saving for a child’s education from their early youth has grown. The “529 Plan” is a growing solution to this issue. Also known as a “Qualified Tuition Plan”, the 529 Plan is designed to fund the future education expenses of your child, grandchild, etc.

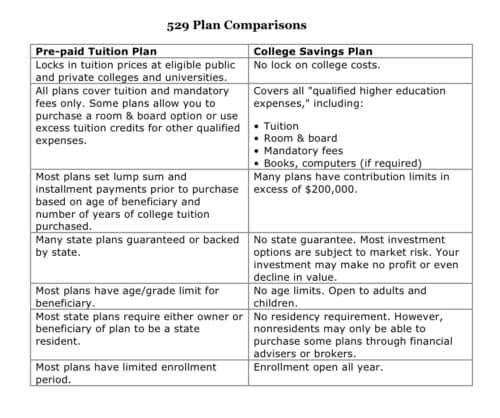

Named for section 529 of the Internal Revenue Code, these plans come in two flavors: Pre-paid tuition plans and college savings plans. Pre-paid tuitions plans are identical to their name, they permit one to purchase credits or future tuition at a participating school. Similarly, college savings plans function in the form of a savings account whereby one establishes an account for the purpose of payment of future college expenses of their child, grandchild, etc. With the college savings plan, the party making the contributions is given the flexibility to invest the funds leading up to the beneficiary reaching college age. For a brief comparison of the two savings plans, please refer to the chart below which is offered by www.sec.gov.

BEWARE!!! Despite all the positive benefits from these 529 plans, there are a few tax pitfalls you need to keep in mind.

The 529 plan is a good tax deferred savings tool for individuals who want to plan for their young relatives college educations. That said, when entering into a 529 plan, please make sure that you have your estate planning attorney incorporate it into your planning.

- Adam Abramowitz, JD and Gary Altman, Esq.